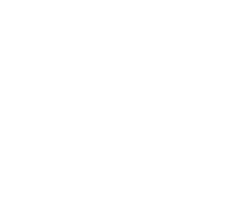

Global Presence

Our Solutions

What's New

MALAYSIAN RE LAUNCHES THE NINTH EDITION OF “ASEAN INSURANCE PULSE” EXAMINING CAPACITY FOR LARGE AND COMPLEX RISKS IN ASEAN

MALAYSIAN RE’S LATEST ASEAN INSURANCE PULSE HIGHLIGHTS RISING DEMAND AND COSTS IN REGIONAL HEALTHCARE

FIFTH EDITION OF MALAYSIAN RE’S “MALAYSIAN INSURANCE HIGHLIGHTS” ANALYSES THE IMPACTS OF A RAPIDLY EVOLVING RISK LANDSCAPE TO THE DOMESTIC INSURANCE MARKET

Malaysian Re Foresights Issue 3

In this edition, we explore the impacts of COVID-19 on the motor insurance market in Malaysia. Our domestic treaties team also share a unique insight from our position as the domestic market leader on...

Malaysian Insurance Highlights 2021

Malaysian Insurance Highlights (MIH) 2021 examines the impact of flooding on its economy and insurance markets. Just as 2021 drew to a close Malaysia was hit by one of the worst floods that the countr...

ASEAN Insurance Pulse 2022

ASEAN Insurance Pulse 2022 emphasises on the contribution of the insurance industry to climate adaptation and resilience building. The report also focuses on impacts of decarbonization in shaping ASEA...

Malaysian Re Foresights Issue 3

In this edition, we explore the impacts of COVID-19 on the motor insurance market in Malaysia. Our domestic treaties team also share a unique insight from our position as the domestic market leader on the latest market trends from the recent January 2021 renewal.

Malaysian Insurance Highlights 2021

Malaysian Insurance Highlights (MIH) 2021 examines the impact of flooding on its economy and insurance markets. Just as 2021 drew to a close Malaysia was hit by one of the worst floods that the country ever experienced. MIH 2021 accentuates the need to address underinsurance as flood risk increases, where the demand for flood cover is influenced by the government’s support of the country’s low-income segment for the loss caused by a disaster.

ASEAN Insurance Pulse 2022

ASEAN Insurance Pulse 2022 emphasises on the contribution of the insurance industry to climate adaptation and resilience building. The report also focuses on impacts of decarbonization in shaping ASEAN economies’ strategies and operations, ranging from its own asset management and underwriting to supporting clean technologies and changes in its own operations.

Industry Contributions

Malaysian Re has been actively involved in underwriting all classes of general reinsurance business from the Malaysian market. It has expanded its business internationally and is actively underwriting business from the Asian, Middle East, and Africa markets. Malaysian Re will continue to provide prompt services and will ensure the existing products to be not only competitive but also meet the requirements of its customers.

Our Milestones

Incorporation of Malaysia Re (Dubai) Ltd (MRDL)

Malaysian National Reinsurance Berhad commenced its operation

Completion of the Group's restructuring exercise and Malaysian National Reinsurance Berhad was known as MNRB Holdings Berhad. The reinsurance business was transferred to a newly incorporated company Malaysian Reinsurance Berhad

Malaysian National Reinsurance Berhad commenced its operation

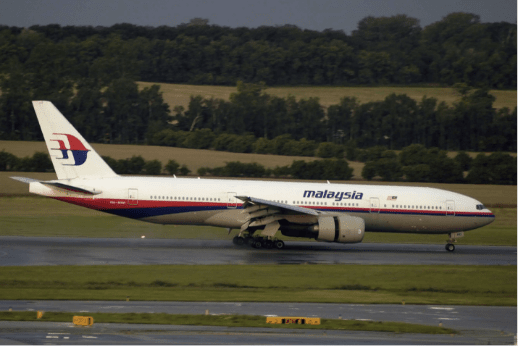

Appointed as manager of Malaysian Aviation Pool

Completion of the Group's restructuring exercise and Malaysian National Reinsurance Berhad was known as MNRB Holdings Berhad. The reinsurance business was transferred to a newly incorporated company Malaysian Reinsurance Berhad